This is continued from Part 1 in which I summarised the Australian Securities Exchange, buying shares in a company, and how the returns of owning shares in a bank, dwarf any returns your savings might make in an interest at that bank. I ended that post telling you that there was a way to buy a single type of share, that represented the whole of the companies in the ASX. You do that through an ETF.

ETFs

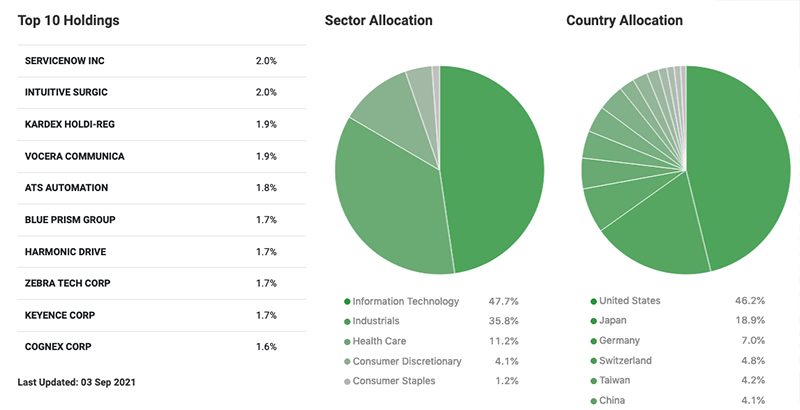

Exchange Traded Funds are a way of buying a single “company” share, that is the equivalent of owning multiple companies shares. The fund buys shares in various companies, and then you buy the shares in the fund. For example; ROBO is an ETF that gives investors exposure to robotics, automation and artificial intelligence. It holds shares in 84 companies, in the USA, Canada, Switzerland, Japan, France, Germany, China, Britain, Belgium, Finland, Ireland, Taiwan and South Korea. Buying shares in ROBO is the equivalent of buying shares in these 84 companies, in these 13 countries.

Diversification

The biggest risk in investing is lack of diversification. If you only own shares in 1 company, then your financial well being is tied directly to the well being of that company. But if you have shares in 84 companies, like in the ROBO ETF then the risk is shared, amongst them. No more than 2% of the money in that ETF is tied to a specific company. Which means, that if one of those companies has some bad luck, does something dumb, or is mismanaged the most you can lose is 1/50th of what you have invested. The financial well being of the shares is tied to the Robotics, Automation & AI sector as a whole. If that sector does well, then some of those companies are going to do well, and the shares in the ROBO ETF will go up in value.

There are ETFs that track any number of specialist investments, like healthcare, sustainability, tech, cybersecurity, space or agriculture. You can invest in narrow interests, or broad ones. And it doesn’t get more broad, more diverse, than investing in the ASX as a whole.

The ASX200

There are a number of different ETFs that track the ASX200. And they essentially work the same way. They buy shares in the top 200 companies in the ASX, ranked by their size. And when you buy 1 share of the ASX200 ETF you are buying a small part of all those companies.

We used my daughters $304.36 to buy 11 shares of IOZ. They were $27.99 (actually, $27.9918) each. The 11 shares totaled $307.91, plus a $2 brokerage fee, for a grand total of $309.91. I donated $5.55 to the cause. You might be thinking, “You can actually buy just $300 worth of shares? The answer to this question, is also yes.

Micro Investing

The buying and selling of shares must be carried out by a licensed stock broker, who charge a brokerage fee for the service. The minimum amount of shares you should buy is directly related to the brokerage fee you have to pay. Your shares need to go up by 2 times the brokerage fee (buying fee + selling fee) just to break even. If you pay a broker $100 to buy $10,000 in shares, the shares need to go up by 2%, to $10,200 for you to sell them at break even. But if you paid $100 to buy $1000 in shares, you need the shares to go up by 20%, to $1200 to break even.

The creation of websites and apps that can automatically do your share buying and selling, have decreased the amount of work that needs to be done by an actual human. Competition being what it is, the amount charged by a licensed broker for the service, has dropped from hundreds of dollars, to a handful of dollars. At the time we bought “my daughters shares”, we had just become aware of the Commbank Pocket Investing app, which charges just $2 to buy up to $1000 worth of shares. The $2 fee worked out to be 0.65% of the price of the shares, which was a very reasonable price to pay.

So that’s what we did. On the 8th of January, 2020.

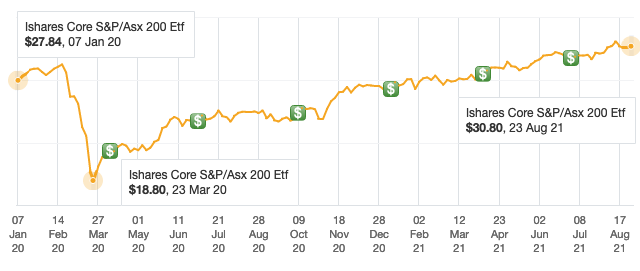

COVID

So then a Pandemic happened. Maybe you heard about it? In March of 2020, the ASX took a dip. Of about 30%. The low point was the 23rd of March, when the shares that we bought with my daughter’s pocket money, dropped from $27.99 a share to $18.80 a share. The shares we spent her $307.91 on were now worth $206.80. So now was the time. To do nothing.

Actually it was the time to buy more shares, as they were a very good price. But failing that, do nothing. And wait. Wait for the ASX to rise. And also, collect those dividends.

Dividends from an ETF

To recap from Part 1, owning a share is owning a small piece of the company. And owning a share of an ETF is owning a small piece of a lot of companies. When any of those companies make a profit, the owners (the shareholders) get paid via a Dividend. And whilst some companies on the ASX were doing it tough, some were doing okay, and were still paying out dividends. Another benefit of diversification.

Most companies pay dividends twice a year, but some ETFs, including the one bought with my daughter’s pocket money, pay every quarter. In April 2020 she received her first dividend, a total of $2.85. 5 more dividends have arrived since then, totaling $14.44. That’s nearly twice the expected total earnings in interest in a 0.5% bank account.

And we continued to wait, and the ASX continued to rise.

23rd of March, 2021

Exactly 12 months after the low of the COVID drop, the ASX ETF was back to the $27.99 share price that it was when we bought it. The shares were worth $307.91 again. Since then they have risen to $30.80 a share, and the 11 shares are worth $338.80. Adding the dividends, the total worth is currently $353.24, for total gains of $45.33. Even though during that time, we had a drop of -30%, we are currently sitting on returns of of 8.55%pa.

And there are 3 more years till she turns 18.

A Long Term Investment

The lesson is, even with a huge drop in share price, just after investing, and with the investment being “a loss” for over 12 months, time in the market eventually works out in our favour. All we had to do, was not sell when the shares were down.